This was originally written and published on my Substack, but I have since decided to move my writing to my own website. You can still find the original here. I share this because I am purposefully re-writing some parts as I work on my writing style. I hope you enjoy!

I’ve always been interested in tools and processes to help me keep on top of my finances. It seems that getting a tool that’s flexible enough to accommodate my budgeting style is difficult. I enjoy the idea behind “zero-based” budgeting1 but I find that it’s a bit too strict for me. For me, maintaining a zero-based budget involves more work than I’m willing to put in just to avoid the (usually minor) consequences of going over my budget by a few bucks. It’s a system-problem for me, rather than an ideological problem. When I overspend on groceries, I don’t want to spend 30 minutes reorganizing my entire budget. Therefore, a tool with the power to define my budget, and the flexibility to get out of my way, is paramount.

Enter Lunch Money.

This is not a paid sponsorship.

I’m just a fan of the product and wanted to share my thoughts.

I’m love tools that get the job done, and get out of the way. Lunch Money does just that.

Calling Lunch Money a “budgeting” software is like calling a Tesla, a “car”. While not technically wrong, there’s quite a bit more to it. It has features such as:

- Automatic Rules: Categorize, tag, or group transactions based on pre-defined rules

- Auto-Import from your bank: You can login to your bank via Plaid in order to automatically sync your transactions! Yay, no more CSV import files or messy excel spreadsheets!

- Charts: Get a visual representation of your financial data

- So much more! Multi-currency support, trends, recurring expenses, family collaboration, unlimited budgets, the list of features is bonkers. Check out the full list of features here.

Lunch Money helps me answer some important financial questions:

Am I generally saving or losing money over X time frame?

If you’re anything like me you have a general feel for how much money you can spend each month, but you don’t know the exact numbers. I found that sometimes, that gut feeling was misleading and I was actually spending more than I thought. This is where Lunch Money can really help by giving you the exact answer to the question: “Am I spending too much?”

I use Lunch Money to do a detailed analysis across not only my budget (i.e. What am I saying I will spend?) but all the actual money that comes and goes. (i.e. What did I actually spend?)

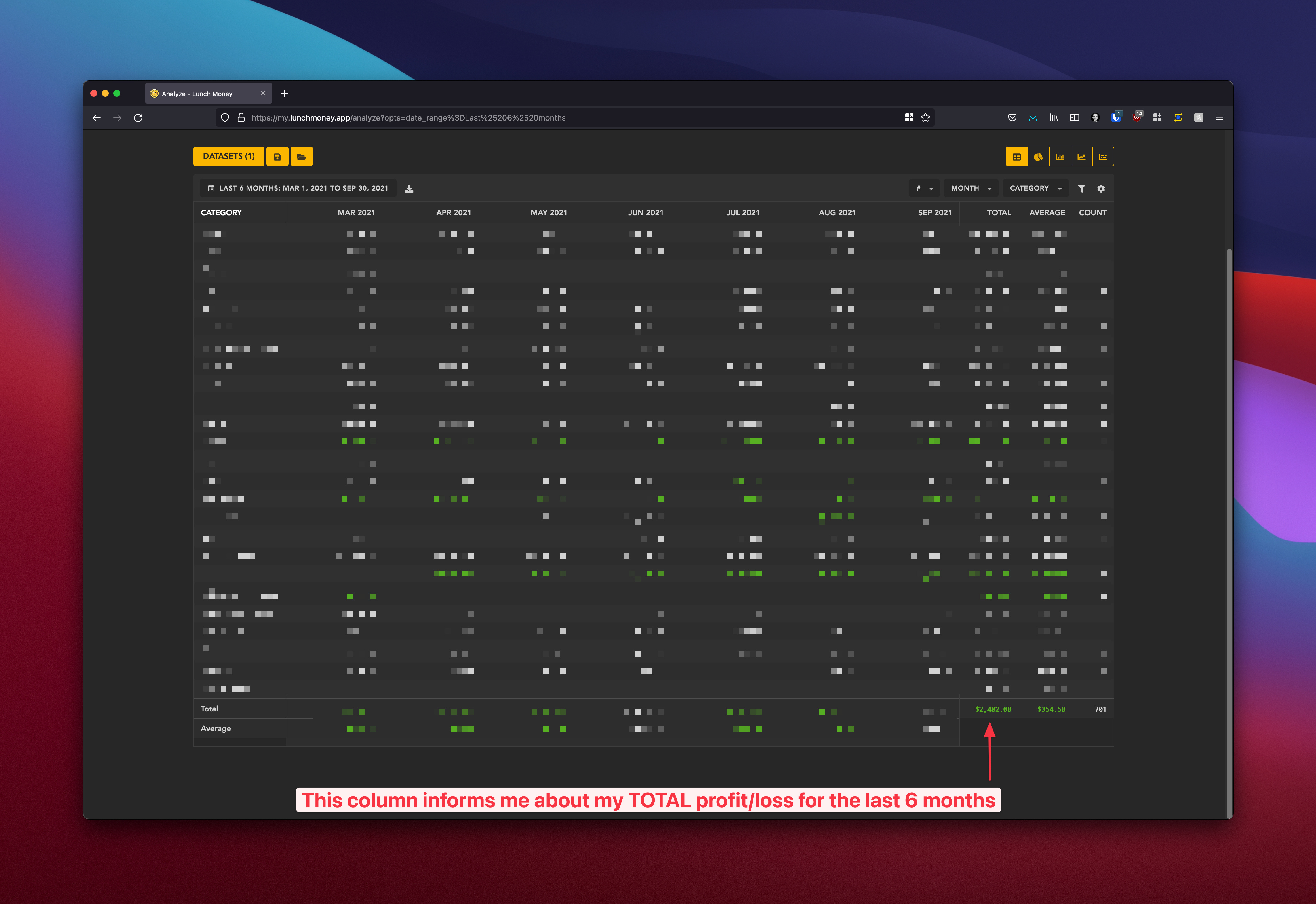

This image shows the net gain/loss for the previous 6 months.

This image shows the net gain/loss for the previous 6 months.

These questions are a great indicator of the financial direction you’re headed. And these are the broadest and most-general of questions we could ask. Notice the answer is built into Lunch Money! I didn’t even have to configure anything.

How much do I need to set aside for this month to pay my essentials?

Between utilities, rent (or mortage), groceries, and video games food—how do I forecast what I needed to set aside

for the coming month? Well Lunch Money has an answer for this as well: The BUDGET page:

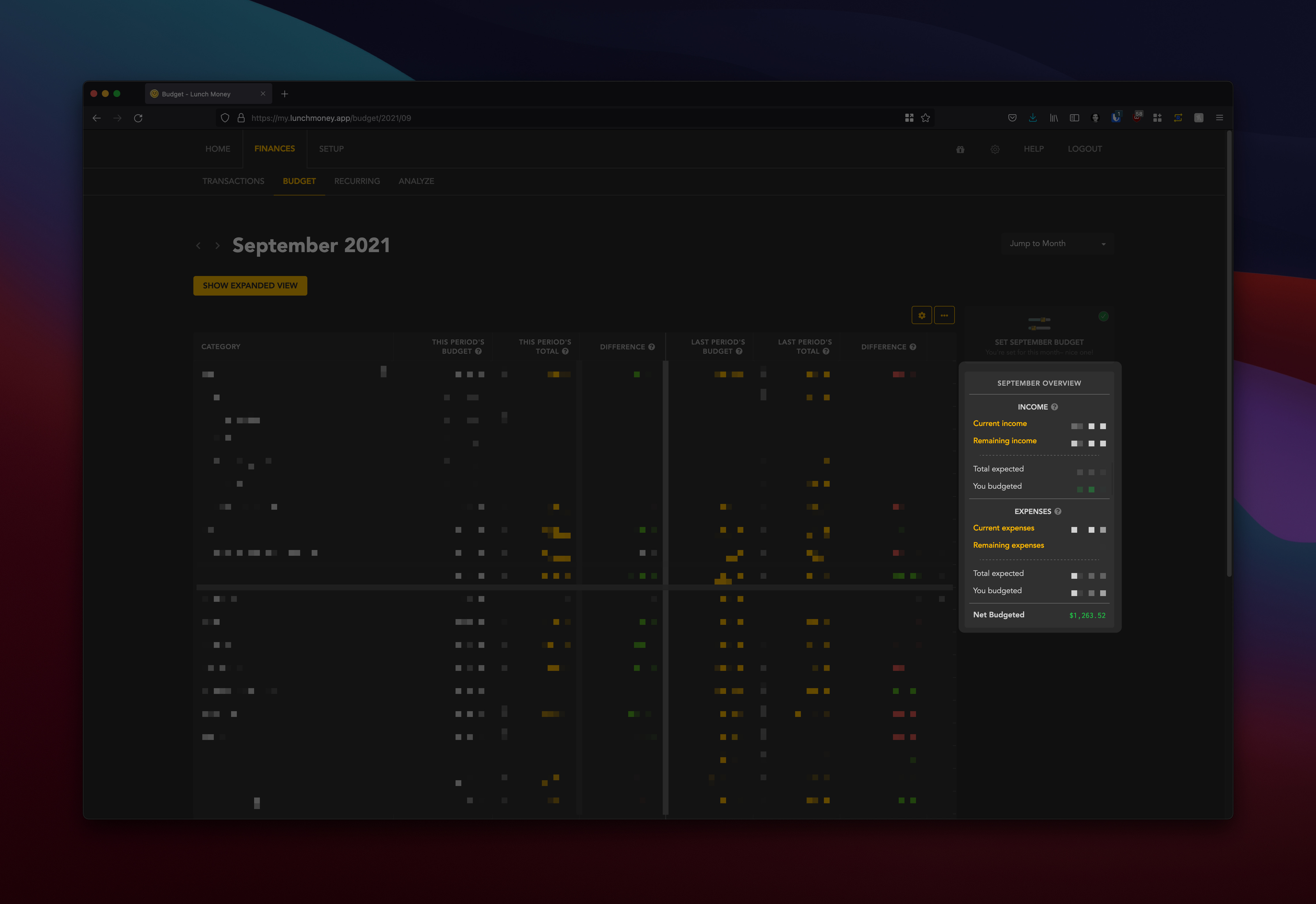

Net budgeted: That’s the amount of “wiggle” room we have in our budget.

Net budgeted: That’s the amount of “wiggle” room we have in our budget.

After setting your budget, the widget on the right gives you a monthly overview that shows what the projected income and expenses for that month will be. This is great for understanding how much wiggle room you have this month. This is updated in real-time so if you want to see how modifying your budget would impact your cashflow for the month, just make those changes and see the overview update to account for those changes.

I’m hungry… Can I go out to eat?

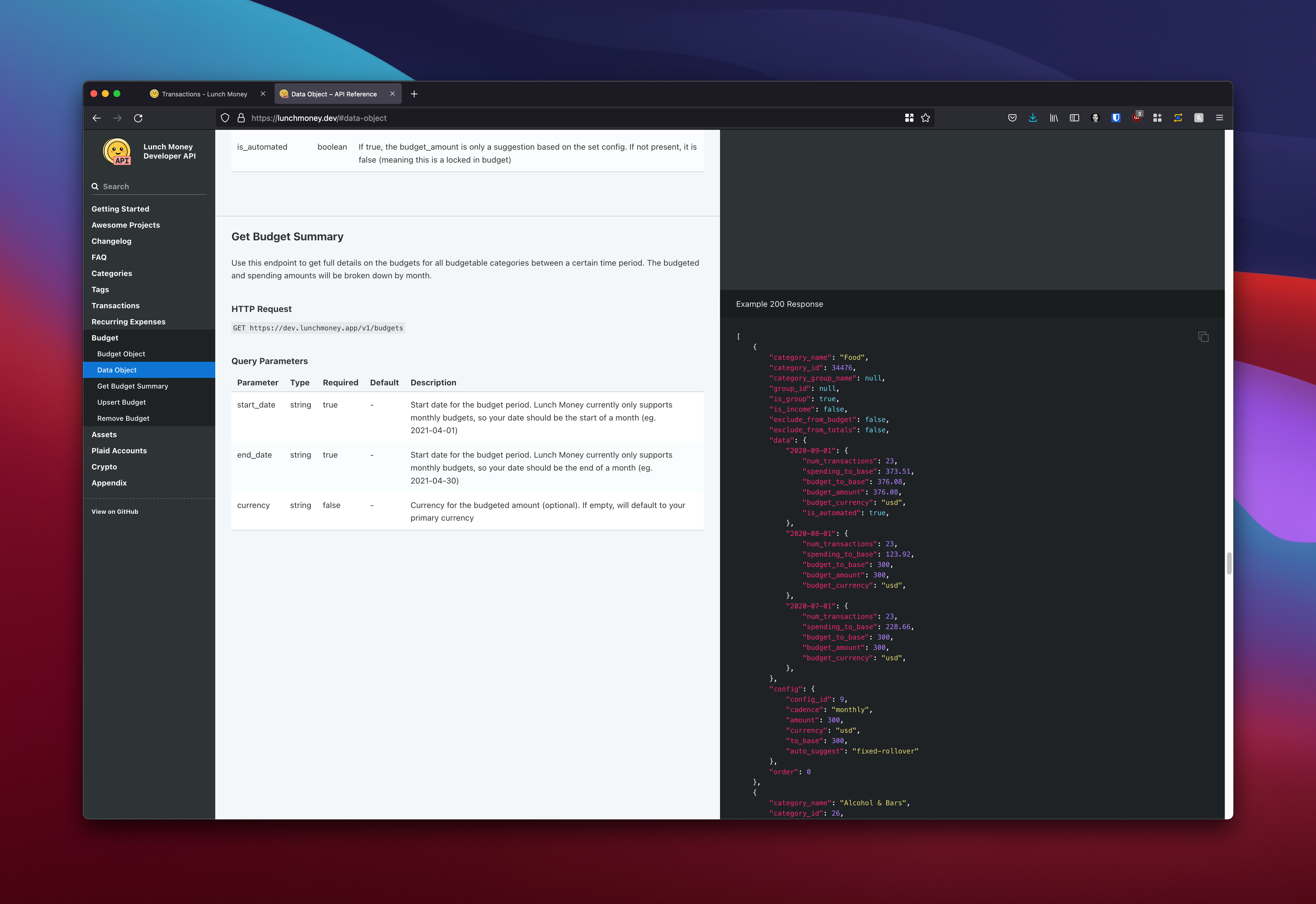

Lunch Money can’t answer this question directly, mostly because it doesn’t have a mobile app. However, utilizing the Lunch Money API, it wouldn’t be too difficult to build an iOS shortcut.

“Hey Siri, can I eat out?”

And trigger the iOS shortcut to calculate the remaining “Eating Out” budget and give the news to you straight.

The developer API is pretty well-documented, and allows for all sorts of fun projects.

The developer API is pretty well-documented, and allows for all sorts of fun projects.

This is the first in a series of posts I’m going to do about Lunch Money.

If you’ve used Lunch Money, I’d love to hear your thoughts! If you haven’t, I encourage everyone to give it a shot.

Footnotes

-

This link breaks down the concept behind zero-based budgeting: https://www.nerdwallet.com/article/finance/zero-based-budgeting-explained ↩

Thanks for reading! If you enjoyed this, you may also enjoy following me on twitter!